south carolina inheritance tax 2021

7 TAX on Lump Sum Distribution attach SC4972. April 14 2021 by clickgiant.

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

There are no inheritance or estate taxes in south carolina.

. The South Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 South Carolina State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The great state of maryland collects both. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

_____ waive all my rights of inheritance _____ waive my right to _____ of shares number this waiver of. Impose estate taxes and six impose inheritance taxes. For deaths that occur.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Explore 2021 state estate tax rates and 2021 state inheritance tax rates. Primarily the inheritance tax was used to fund wartime efforts and was levied nationwide from 1797-1802 1862-1870 and 1898-19027.

While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due. Your federal taxable income is the starting point in determining your state income tax liability. South Africans over the age of 18 have two allowances for transferring funds offshore per calendar year.

Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. There is no inheritance tax in south carolina. On june 16 2021 the governor signed sf 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning january 1 2021 through december 31 2024 and results in the repeal of the inheritance tax as of january 1 2025.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation. On june 16 2021 the governor signed sf 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning january 1 2021 through december 31 2024 and results in the repeal of the inheritance tax as of january 1 2025. Unlike some other states there are no inheritance or estate taxes in south carolina.

South Carolina does not levy an estate or inheritance tax. A R1 million single discretionary SDA which does not require tax clearance and a R10 million foreign investment allowance FIA which requires tax clearance. The South Carolina Department of Revenue is responsible.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. 2021 South Carolina Individual Income Tax Tables Revised 32321 At least But less Your tax 3000 6000 11000 17000 0 50 0 3000 3050 0 6000 6050 87 11000 11100 304 17000 17100 665 50 100 0 3050 3100 0 6050 6100 89 11100 11200 309 17100 17200 672 100 150 0 3100 3150 0 6100 6150 90 11200 11300 314 17200. South carolina inheritance tax 2021.

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of.

As in north carolina south carolina does not tax social security benefits. For 2021 the nonrefundable credit is equal to 8333 of the. 8 00 9 TAX on excess withdrawals from Catastrophe Savings Accounts.

Individual income tax rates range from 0 to a top rate of 7 on taxable income. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. This variable assesses if a state levies an estate or inheritance tax.

Unlike some other states there are no inheritance or estate taxes. South carolina inheritance tax waiver. South carolina inheritance tax and gift tax.

This is your TOTAL SOUTH CAROLINA TAX10 00 30752216 Page 2 of 3 Your SSN _____ 2021. What are the inheritance laws in South Carolina. Twelve states and Washington DC.

South carolina inheritance tax 2021. However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies. In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax.

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds for example in 2021 the federal estate tax exemption amount is 117 million for an individual receipt of an inheritance does not result in taxable income for federal or state income tax. Nations top inheritance tax rate 18 on remote relatives and non-related heirs6 Inheritance Tax History The United States has a long history of using the inheritance tax to fund government operations. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications.

Maryland is the only state to impose both. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance tax. Inheriting from South Africa in 2021 and beyond.

Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. If your taxable income is. South Carolina does not levy an estate or inheritance tax.

Large estates that exceed a lifetime exemption of 1206 million are subject to the federal estate tax. South carolinians pay an average 601. Tax brackets are adjusted annually for.

7 00 8 TAX on Acvtie Trade or Busniess Income attach I-335. Not all estates must file a federal estate tax return Form 706. South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed.

You should also keep in mind that some of your property wont technically be a part of your estate. What expats need to know. 9 00 10 Add line 6 through line 9 and enter the total here.

No estate tax or inheritance tax No estate tax or inheritance tax.

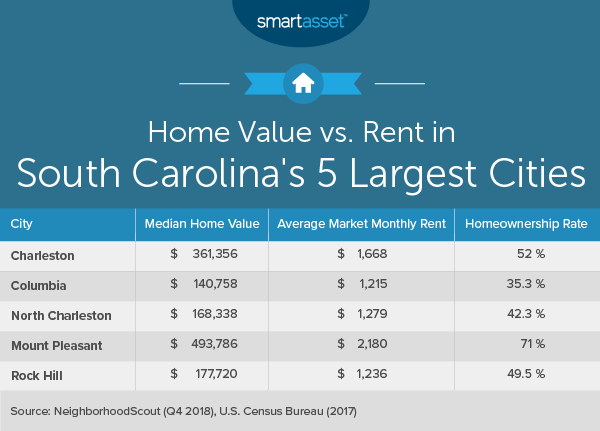

South Carolina Inheritance Laws What You Should Know Smartasset

South Carolina Income Tax Calculator Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

South Carolina Estate Tax Everything You Need To Know Smartasset

Pin By Susan Herrmann On Retirement In 2022 Order Of Operations Estate Planning Federal Income Tax

South Carolina Estate Tax Everything You Need To Know Smartasset

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

The Ultimate Guide To South Carolina Real Estate Taxes

South Carolina Retirement Tax Friendliness Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Real Estate Property Tax Data Charleston County Economic Development

The True Cost Of Living In South Carolina

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Retirement Taxes And Economic Factors To Consider

South Carolina Inheritance Laws King Law

Cost Of Living In South Carolina Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset